income tax rates 2022 uk

2 days agoA corporation tax rate of something over 50 might be required for the effect to be seen. Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use the Scottish Income Tax Rates and Bands if you live in Scotland.

Tax Day 2021 Key Announcements Tax Day Business Infographic Announcement

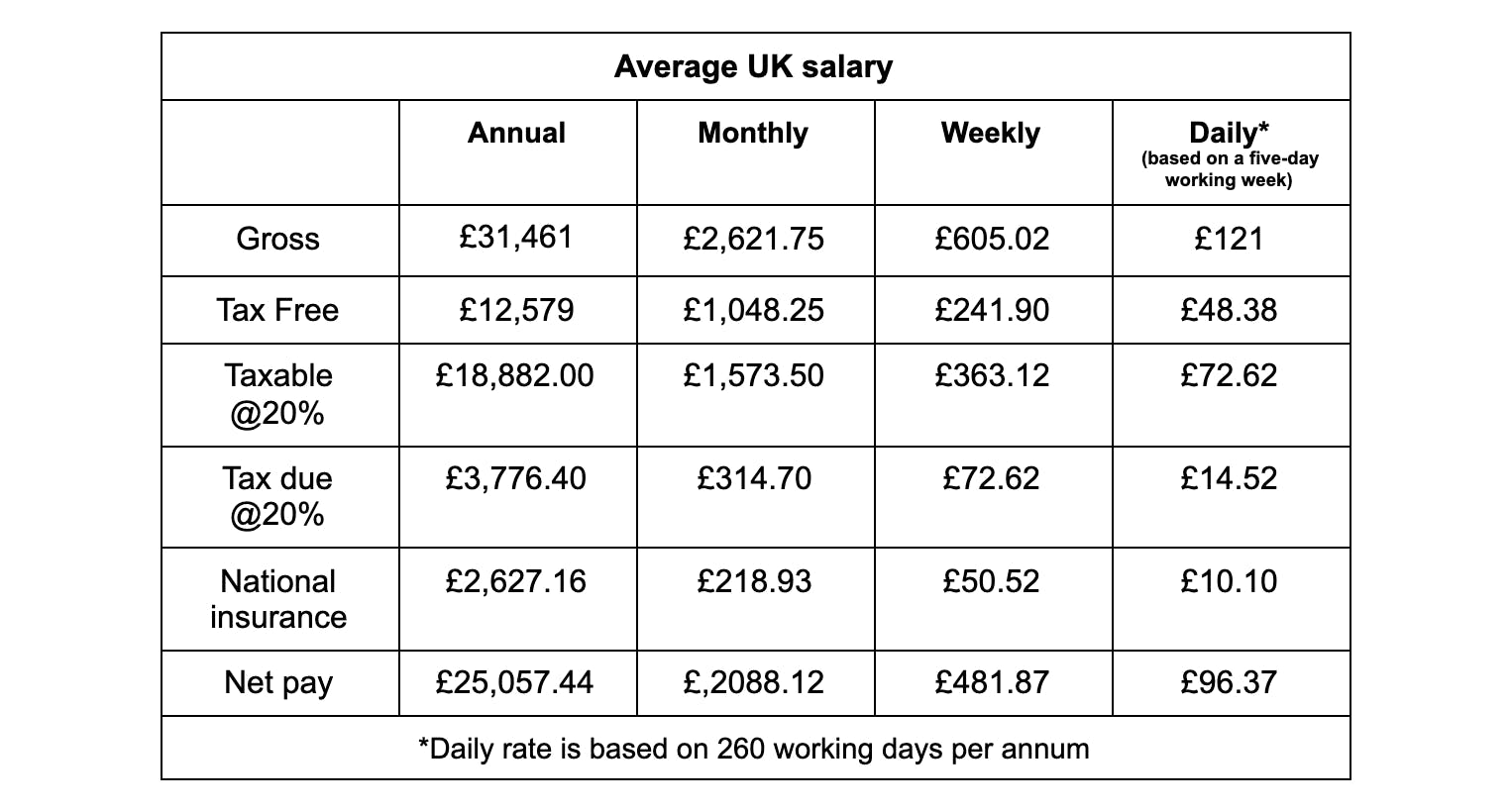

The rate you pay depends on your income tax band as shown in the table below.

. The employer rate is 0 for employees under 21 and apprentices under 25 on earnings up to 967 per week this is 242 starting 6 June 2022. Heres what you need to know about state income tax rates including states with no income tax. Such tax costs also only work if regulation in other states let companies ultimately owned there move to the UK and take advantage of them.

This means employees and self-employed people will. Tax is charged on total income from all earned and investment sources less certain deductions and allowances. Tax is charged on taxable income at the basic rate up to the basic rate limit set at 37700.

Personal income tax rates Income tax is charged at graduated rates with higher rates of income tax applying to higher bands of income. Basic rate Anything you earn from 12571 to 50270 is taxed at 20 Higher rate Anything you earn from 50571 to 150000 is taxed at 40 Additional rate Anything you earn over 150000 is taxed at 45. Income tax on earned income is charged at three rates.

After that the basic rate of 20 Income Tax is levied on earnings between 12571 to 50270 the higher rate of 40 is for earnings between 50271 to 150000 and the additional rate of 45 is for any earnings over 150000. A scottish taxpayer with total income of 50000 assuming this is all earned income will have a tax liability of 897510 in 202223 personal allowance of 12570. The minimum wage rate per hour in UK increased with effect from 1 April 2022.

Tax brackets 202223 Class 1 employed rates For employees For employers Please note. The rates are as follows. For the 2022-23 tax year the Welsh Assembly has decided to stay in line with the income tax rates that govern England and Northern Ireland.

With flat tax rates you pay the same tax rate no matter how much income you have. States With Flat Tax Rates. Latest Tax Financial News and Updates.

Obviously with the freezing of personal tax rates and the increase in National Insurance many people are facing a reduction in take home pay together with an increase in bills. Find your classification by looking up your NIC letter on your payslipreturn Primary Threshold is 190 until 6th July 2022 Shared Banding For All NICs Rates for Class 1 NICs Self Employed Class 2 and Class 4 NICs Voluntary Class 3 NICs Weekly rate 1585 Corporation Tax - Calculate Corporation Tax Corporation Tax Rates and Limits. 23 hours agoBritish Chancellor of the Exchequer Nadhim Zahawi leaves his home in central London Britain July 11 2022.

Income between 50271 and 150000. Your tax-free Personal Allowance The standard. Many states have moved away from flat-tax structures because critics claim that they unfairly burden low- and middle-class taxpayers.

The current tax year is from 6 April 2022 to 5 April 2023. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. For 202223 these three rates are 20 40 and 45 respectively.

Between 6 July 2022 and 5 April 2023 this weekly threshold will increase to 242. The higher rate threshold is equal to the Personal Allowance added to the. Youre only charged tax on the amount you earn above the dividend allowance which is 2000 in 2022-23 unchanged from 2021-22.

These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023. REUTERSHenry Nicholls LONDON July 11 Reuters - British finance minister Nadhim. The Personal Allowance is set at 12570 for 2021 to 2022 and the basic rate limit is set at 37700 for 2021 to 2022.

The table shows the 2022 to 2023 scottish income tax rates you pay in each band if you have a standard personal allowance of 12570. Everyone who earns income in the UK has a tax-free personal allowance of 12570 per year. Income between 12571 and 50270.

Income between 12571 and 50270 - 20 income tax Income between 50271 and 150000 - 40 income tax Income above 150001 - 45 income tax Note that your personal allowance will reduce by 1 for every 2 you earn over 100000. The top marginal income tax rate of 37 percent will hit taxpayers with taxable. On 23 March 2022 the UK Government announced at Spring Statement 2022 an increase in National Insurance thresholds for the 2022 to 2023 tax year.

Entitlement to contribution-based benefits for employees retained for earnings between 123 and 190 per week. 0 income tax this is your tax free Personal Allowance. Meanwhile a taxpayer subject to the uk.

The basic rate the higher rate and the additional rate. There are seven federal income tax rates in 2022. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The current corporate tax rate is 19. This guide is also available in Welsh Cymraeg. From April 2023 onwards employees will be able to earn 242 each week equivalent to 12570 a.

The National Insurance contribution rates will go back down to 2021 to 2022 levels and the levy will become a separate new tax of 125. Unlike the rest of the UK which goes directly to central Government the income tax from Scottish income tax deductions is paid to the Scottish Government. You may have to pay dividend tax if youre an investor that earns money from owning company shares.

Minimum Wage in UK. The main allowance is the personal allowance which is GBP 12570 in 202122.

A New Study Reveals The Most Popular Brands Across The Uk And Europe Vivid Maps In 2022 Europe Map Brand Fashion Brands

80 000 After Tax 2022 Income Tax Uk

Usa Oracle Software Company Pay Stub Word And Pdf Template In 2022 Oracle Software Templates Pdf Templates

Bronchiolitis Nursing Notes Paediatric Nursing Etsy Canada In 2022 Pediatric Nursing Nursing Students Nurse Study Notes

2 000 000 Calculadora De Impuestos Chile Salario Despues De Los Impuestos Impuesto Sobre La Renta Calculadora Impuesto

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Changes To Scottish Income Tax For 2022 To 2023 Factsheet Gov Scot

Ppi Claim Letter Template For Credit Card Best Business Intended For Ppi Claim Form Template Letter In 2022 Lettering Letter Templates Business Letter Template

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Economia De Rep Dominicana Crecera 5 5 En 2021 Segun El Banco Mundial Economia Dominicano Presupuestos Generales Del Estado

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Stamp Duty Land Tax For Limited Companies In Uk In 2022 Stamp Duty Stamping Companies Company

How Much Tax Does A Premier League Footballer Pay

El Impuesto Sobre La Renta O Income Tax En El Reino Unido

The Salary Calculator Income Tax Calculator Salary Calculator Income Tax Salary